Sommeliers Choice Awards 2024 Winners

Best practices that Spirits, Beverage, Beer and Wine Distributors use to grow profits

Here are some of the best practices that Wine, Spirits, Beverage and Beer Distributors use to grow profits:

Best practices that Spirits, Beverage, Beer and Wine Distributors use to grow profits:

Best Practice: Customer Stratification

Customer stratification may sound like an odd idea in a climate where any paying customer is a good customer. Still, the sales force has two issues to deal with: First, who do I call on that has a chance of giving me an order and paying for it? Second, who should I be calling on, and how do I secure relationships that will still be worthwhile when the economy takes off?

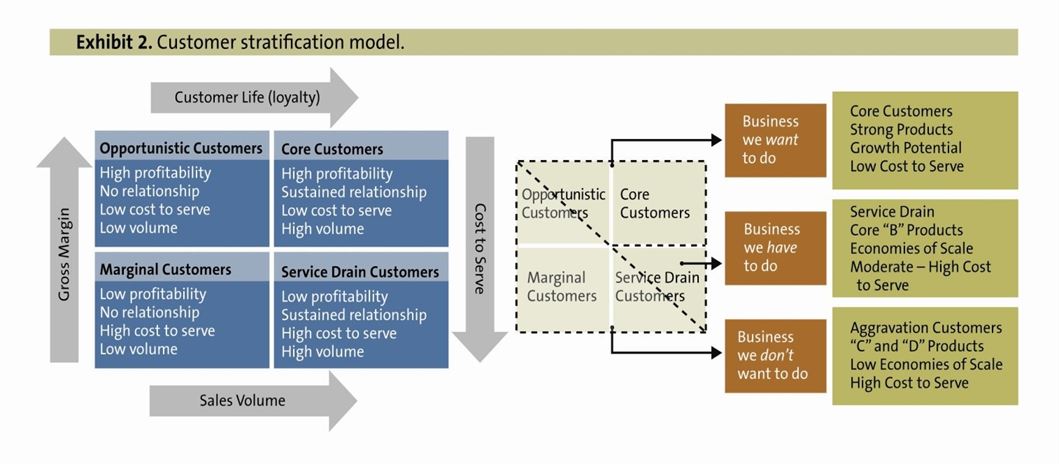

Customer stratification answers these questions and many other, perhaps more important, ones. Customer stratification measures how much business a customer does with us (sales), how profitable they are in gross margins, how loyal they are, and how costly they are to serve (to protect net margins). Each of these dimensions has a bearing on the sales force’s questions.

Customer stratification techniques are gaining popularity, but they often are not applied correctly. The practice levels for customer stratification are as follows:

COMMON practice: 1) No defined customer stratification (2) Customer groups based on market type or product line (3) Top customers based on revenue

GOOD practice: Based on a single factor (1) Volume [sales $] based (2) Gross margin (3) Business potential

Volume (sales) is critical to achieve economies of scale. The fact that gross margin customers are willing to pay in down times says a great deal about what they’ll do in up markets. Beggars can’t be choosers, but given the choice of calling on high- margin versus low-margin customers is a no-brainer.

BEST practice: Based on multiple factors (1) Cost to serve, customer loyalty, business potential, profitability, and relationship (2) Combination method

Loyalty is important since replacing customers and chasing customers who come and go is expensive. Finally, cost-to-serve will overwhelm the gross margin if the customer drives services through the roof. In a down market, the sales force may give away services easily just to capture short-term sales. There are long-term consequences for these decisions.

Customer stratification can be used in conjunction with other best practices. Pricing is an obvious one. Sales force redeployment is another. Pricing decisions include many factors but essentially they start with the customer and the nature of the relationship. Sales force redeployment determines not only which customers the sales force will call on, but how much time they will spend with each and the nature of that discussion.

Pricing

One distributor set up a pricing methodology to increase its margins. A key part of the strategy was customer stratification. When quoting, the salesperson would open a screen that gave a recommended price based on customer stratification, item stratification, unit cost, previous margins, and customer-item visibility. The last four items came from the system’s data and were undeniable. The key issue was the customer’s status.

The distributor’s screen listed the customers according to the stratification as Core, Opportunistic, Service Drain, and Marginal. These terms come from Pricing Optimization research at Texas A&M University for a complete description of the Customer Stratification technique and how to implement it). The customer stratification model is shown in Exhibit 2. The distributor chose a different set of names for its application.

Image Source: NAW Institute for Distribution Excellence

The salesperson would open the screen, see the recommended price, and then examine the customer’s status. Even though the system had already factored in the customer stratification, the sales force needed the additional comfort of knowing that core customers were properly identified. The strategy worked like this: If the salesperson was planning to ask for a 22% margin and the system came back with a 28% margin recommendation, maybe the salesperson would split the difference. In a pricing environment, a 1% increase in gross margin can easily mean a 20% increase in net margin.

The process worked better than expected with gross margins growing by more than 6 points (6% or going from 22% to 28% gross margin in our example). The key component was and is the customer stratification. The salesperson split the difference on the low side in the beginning but, as they gained confidence, moved closer and closer to the system’s recommendation.

Sales Force Redeployment

The sales force makes a sincere effort to call on the right customers and spend the right amount of time with those customers. Still, the salesperson may or may not understand whether the customer is in fact a Core customer or an opportunistic one worthy of pursuing. Without the right analysis, the sales force makes decisions about who to spend time with and give services to based on their perspective of the customer relationship. Sometimes they’re right, but often they give away services to Service Drain customers or discounts to Marginal customers thinking they are, in fact, Core or Opportunistic customers. Exhibit 3 describes the link between customer stratification and shareholder value.

A powerful example of working with Core customers comes from an oil field services firm. The sales representative worked with the operations manager for the customer on taking control of the warehouse. Up to that point, the distributor was the largest but not the only supplier for the operation. The operations manager had instituted a significant measurement system and was disappointed with the performance of the warehouse.

A powerful example of working with Core customers comes from an oil field services firm. The sales representative worked with the operations manager for the customer on taking control of the warehouse. Up to that point, the distributor was the largest but not the only supplier for the operation. The operations manager had instituted a significant measurement system and was disappointed with the performance of the warehouse.

Contractors working for the customer ordered far more material than they needed since they did not trust the warehouse to have the material on time. The result was excessive, obsolete materials when the contractors did not use everything they ordered. The warehouse was awash in inventory.

The distributor’s sales rep worked up a strategy based on the customer’s measurements (which were driven by return-on-net-assets or RONA). He got the customer to agree to share improvement in RONA in exchange for the distributor managing the warehouse. The sales rep then worked closely with the contractors to build confidence, disperse the dead inventory through their own network, and improve picking and tracking procedures.

Since the distributor’s network was far larger than the customer’s, the distributor was able to reduce a significant amount of inventory through redeployment. By winning the contractor’s confidence, the distributor was able to significantly reduce excess orders. Finally, through demonstrating value add directly in RONA, the distributor won a larger portion of the customer’s business at that location and rolled the program out worldwide for an even greater gain.

The distributor did not take ownership of the inventory. The investment came in the form of the sales rep’s time to set up and run such a program and additional human resources in onsite management. The decision to redeploy these resources was made rationally based upon the customer’s status (Core). The additional services were directly compensated for through the RONA split. If additional resources are not compensated for, the distributor’s cost-to-serve rises without higher compensation and turns the customer into a Service Drain.

Source: NAW Institute for Distribution Excellence

Beverage Trade Network

Not a BTN Member yet?

Get BTN Premium membership and have full access to articles and webinars on BTN + other benefits like:

Full Access to BTN Consultants

Full Access to Buying Leads

Post Unlimited Brands

Full Access to all Articles and Webinars

Full Access to BTN Live conferences presentations and speaker sessions

Discounted rates to exhibit at major partner events and conferences

And Much More...

Your BTN membership will reduce your trial and error time: Why experiment with your branding and distribution when you can fast-track your time to success? Get 'How to do it' content which will help you improve your sales and grow your distribution. Just one article can help you make better decisions and improve your distribution strategy. Try it

.jpg)